Some interesting comparisons:

Some interesting comparisons:- We spend less on fuel here, even though it is twice as expensive (we drive less)

- We spend 1% more on clothing here (retail prices are more like +15% actually)

- Rent is 23% of our income here, compared to 13% in Seattle

- We're able to save more here, and the quality of life is higher

- Internet is constant at 1% for comparable wireless

- We pay cash for a lot of stuff here, because there are a lot of places that don't take plastic

- Health care was 5% in the US (out of pocket), vs. 1% here for better cover

UPDATE: 2011 Cost of Living and Taxes below

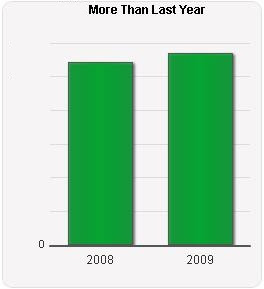

So after a year I thought it was time to tally up the expenses again for a year-on-year comparison. Note that the data is taken from roughly a 3mo period from each year. For 2011 I broke out some more stats and compounded some others, like others+stuff = stuff 2011, and health insurance+medical 2010 = medical 2011.

So after a year I thought it was time to tally up the expenses again for a year-on-year comparison. Note that the data is taken from roughly a 3mo period from each year. For 2011 I broke out some more stats and compounded some others, like others+stuff = stuff 2011, and health insurance+medical 2010 = medical 2011.Karin figured out we could file an amended 2009 return because we now pass the residency test. Note that you are only allowed to leave Australia for 30 days per year to avoid being double-taxed by the IRS. Also, the 2011 TurboTax interface is much improved over the 2010 version with respect to foreign income.

UPDATE 2014 - Long-term subjective review:

Sydney is extremely expensive. Much more so that Seattle. Although wages are higher. You should ask for ~40% more coming here, e.g. 70k USD -> 100k AUD to maintain the same standard of living. Housing is a big one, but then, once you have kids, it's the daycare which will slay you financially. It can be easily as expensive as rent, which is insane on it's own. For a crappy 2br apt in Sydney you can expect to pay $2000/mo. So that + daycare can be as much as $4000/mo, and possibly more depending on your income. Honestly I don't know about Seattle daycare costs, but this combination makes having a kid in Sydney ill-advised.

I would like to track this and get more data on your progress. Are you generally happier in Sydney which is qualitative question rather a quantitative one.

ReplyDeleteAlso I imagine you'll make more capital appreciation on property investments, since uncle sam is in -ve values right now.

I'd say we are much happier here. We're about to move to the beach (Coogee) and we don't worry about healthcare finagling. We aren't planning on buying anything here really, as we would have to settle for something that would be far below our current standard of living. I'm talking about a small condo for $350k in the inner west neighborhoods... why live like that? Property opportunities in the US are enviable right now by comparison!

ReplyDeleteHey,

ReplyDeleteI'm thinking of accepting an offer to Sydney for work. What experience did you have with your US taxes and your Australian taxes?

Thanks

Katrina.THompson@gmail.com

Our US taxes were not good. I left AU for 6 weeks during the tax year, which put me into a bracket where I had to pay double tax, e.g. I paid US tax on my AU income. Typically you won't have to pay double tax, as there is a tax treaty between the US and AU.

ReplyDeleteHad we known, we could have filed for an extension and received a return of $2500, but instead we had to pay $500.

Overall not bad though, turbo-tax had a great online AU-US interface. The only part they missed was suggesting filing for the extension.

The US and AU tax years do not line up. US ends Jan, AU ends Jun. For your US taxes, you will report only the AU income earned from Jan-Jan of that year. For the AU taxes, I won't have earned any US income from Jun-Jun so it should be relatively simple.

Overall, worry about it enough to start processing your taxes early, but make sure you try to take advantage of filing extensions if you don't meet the guidelines for the tax treaty "total time in Australia for the year."

I think you should not weigh taxes too heavily into your decision. It's a great experience.

I've just updated this for 2011, in case y'all ar curious. I'd love to here from anyone that decided to move. We have at least another 2 years here.

ReplyDeleteAnother update for 2014. Sydney is... holy crap. So expensive. In the end, we didn't make enough money to stick around after karin's income stopped. We are moving to Germany but might be back someday, although not to live in Sydney, unless we become filthy rich in the meantime.

ReplyDelete